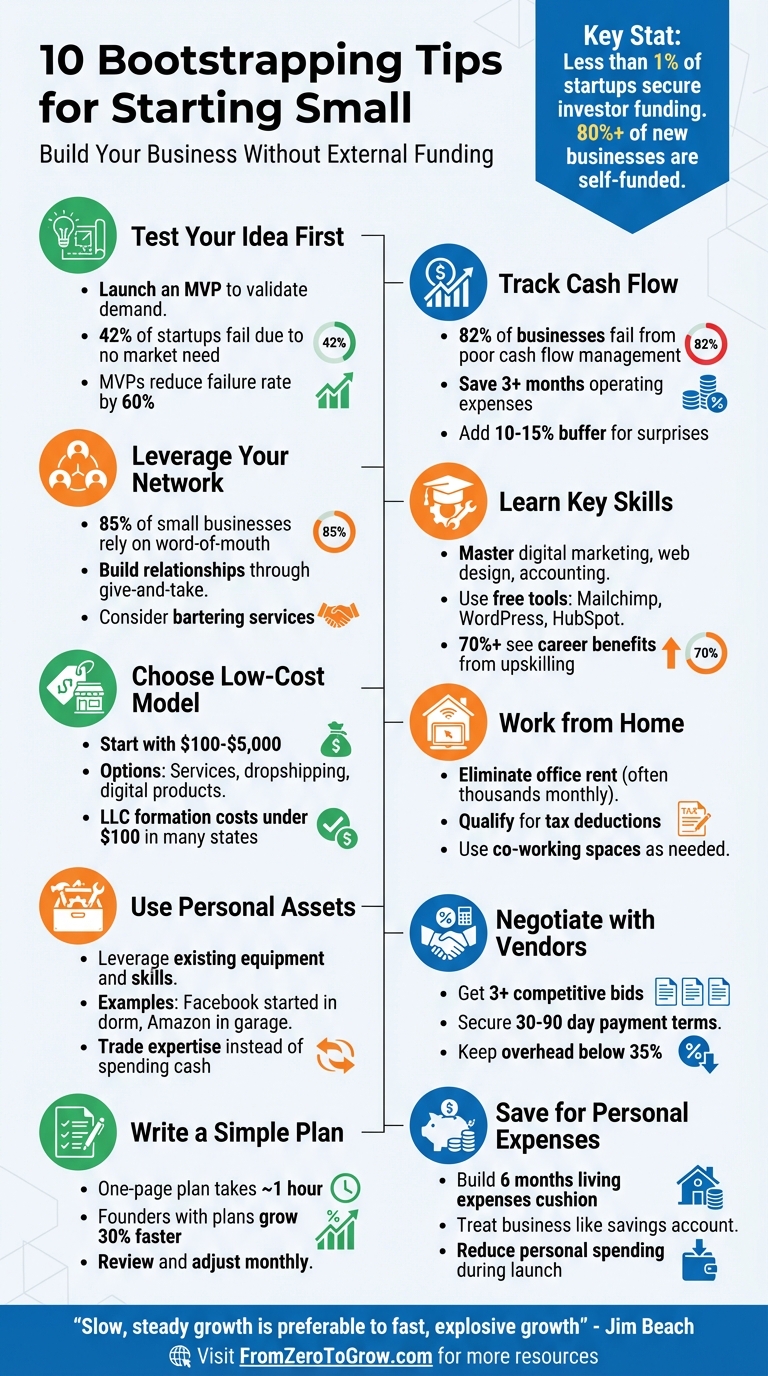

10 Bootstrapping Tips for Starting Small

Practical bootstrapping tips: validate with an MVP, track cash flow, cut costs, use your skills and network, and save for personal expenses.

Bootstrapping a business means using your own savings and reinvesting revenue to grow, without relying on external funding. Since less than 1% of startups secure funding from investors, most entrepreneurs turn to this method to stay in control and build sustainably. Here are 10 actionable tips to help you succeed with limited resources:

- Test Your Idea First: Start with a Minimum Viable Product (MVP) to validate demand without overspending.

- Track Cash Flow: Monitor every dollar and reinvest profits wisely to avoid financial pitfalls.

- Leverage Your Network: Build connections for referrals, partnerships, and even bartering services.

- Learn Key Skills: Handle tasks like marketing or web design yourself to save on hiring costs.

- Choose a Low-Cost Model: Opt for service-based businesses, dropshipping, or digital products.

- Work from Home: Skip office expenses by running your business from home and using co-working spaces as needed.

- Use Personal Assets: Start with what you already own - equipment, skills, or savings.

- Negotiate with Vendors: Secure better deals or flexible payment terms to lower costs.

- Write a Simple Plan: A focused one-page business plan can guide your decisions and keep you on track.

- Save for Personal Expenses: Build a financial cushion to cover living costs during the early stages.

Bootstrapping requires discipline, planning, and resourcefulness, but it allows you to grow on your terms. Start small, stay focused, and prioritize steady growth.

10 Essential Bootstrapping Tips for Starting a Business with Limited Resources

Bootstrapping a Start-Up: Real Lessons from a $30M Founder

1. Test Your Idea with a Minimum Viable Product

Before pouring thousands into your idea, make sure people actually want it. A Minimum Viable Product (MVP) is the simplest form of your concept that addresses one key problem. It’s a smart way to conserve your resources while gathering honest feedback from real customers - not just friends and family who might sugarcoat their opinions.

Here’s why this matters: 42% of startups fail because there's no market need for their product. On the flip side, entrepreneurs who use MVPs see a 60% lower failure rate. If you’re bootstrapping, you can’t afford to gamble. You need proof that people are willing to pay for your solution before committing months of effort and money. As the Nerdify Blog wisely puts it:

"Your biggest risk isn't failing to build your product; it's spending all your time and money building something nobody actually wants." - Nerdify Blog

Take inspiration from some well-known success stories. Zappos founder Nick Swinmurn didn’t start with a warehouse full of shoes or a fancy inventory system. He simply took photos of shoes from local stores, posted them online, and only bought the shoes at retail price after customers placed orders. Similarly, Groupon began as a simple email list offering a two-for-one pizza deal to just 500 people. Founder Andrew Mason built it in a month to test if group buying had any traction. And Spotify? It launched with a bare-bones prototype featuring just a handful of hard-coded songs to prove instant music streaming could work.

To refine your MVP, start by interviewing 10–15 potential customers to understand their biggest frustrations. Then, create only what’s necessary to solve that one issue. Use tools and templates that are already available instead of building everything from scratch. Remember, you can always add bells and whistles later - after you’ve confirmed people actually want what you’re offering.

2. Manage Your Cash Flow Carefully

Cash flow issues are the silent killers of many small businesses. In fact, 82% of businesses fail because they don't manage their cash flow well. For bootstrapped ventures operating on tight budgets, understanding the gap between revenue and actual cash in the bank can be the difference between survival and failure.

Start by tracking every dollar. Use simple tools like Google Sheets or Excel, or opt for budget-friendly apps such as Cash Flow Planner, FreshBooks, or Square Analytics to handle invoicing and expense tracking automatically. The trick? Pick a system that works for you and stick with it. Consistent tracking builds the foundation for smarter financial decisions.

Take Tailored Ink as an example. In August 2015, Han-Gwon Lung and Dan Foley launched their copywriting agency with just $1,000 between them. They kept personal expenses low and reinvested every penny of profit back into the business. By 2017, they were nearing $1 million in revenue - all without taking out loans or maxing out credit cards.

Set up a cash reserve to cover at least three months of operating expenses, plus a little extra. Add a 10% buffer to individual expense items and a 15% cushion to your total monthly costs to handle any surprises. To keep cash flowing, invoice clients as soon as work is completed and consider offering small discounts for early payments. As Warren Buffett famously said:

"If you're smart, you're going to make a lot of money without borrowing".

Another critical step? Keep your personal and business finances completely separate. Mixing the two leads to confusion, potential tax issues, and an unclear view of your actual financial situation. For bootstrapped businesses, financial clarity isn’t just helpful - it’s essential for survival.

3. Build a Strong Professional Network

When you're bootstrapping, your network isn’t just helpful - it’s a lifeline. 85% of small businesses say word-of-mouth referrals are their most effective way to attract local customers. For businesses running on tight budgets, this isn't optional; it’s a core survival tactic.

So, how do you build a network that works for you? Networking thrives on give-and-take. By offering referrals, testimonials, or even promoting someone else’s work, you can establish trust. This goodwill often circles back in the form of opportunities for your own business. As ZenBusiness explains:

"Networking in business is about creating trusting relationships and friendships with other businesspeople".

Leverage affordable tools like LinkedIn or attend local Chamber of Commerce events to connect with others. Even casual, informal settings can lead to meaningful relationships. The secret? Show up regularly and focus on listening more than talking.

Another resourceful approach is bartering. Exchange your expertise for services you need - maybe trade your marketing skills for IT help or swap design work for legal advice. This not only saves cash but also fosters stronger ties with fellow entrepreneurs who understand the same struggles. Plus, organizations like SCORE offer free mentorship from seasoned business owners who’ve been in your shoes.

Keep the momentum going by following up with new contacts within a week. A friendly email or LinkedIn message can make all the difference. And don’t forget to have a clear, concise elevator pitch ready - something that explains what you do, who you help, and what sets you apart. These small but intentional steps can transform casual introductions into enduring partnerships, helping your business weather the challenges of its early days.

4. Learn Key Skills Yourself

Cutting costs is crucial when you're bootstrapping a business. One of the smartest ways to save money is by developing essential skills yourself instead of hiring outside help. With over 80% of successful startups self-funded for under $500,000 - and many starting with as little as $10,000 - founders often need to juggle multiple roles to keep things running lean.

Start with digital marketing. Skills like SEO, social media management, and email marketing are invaluable, and you can build your expertise using free tools like Mailchimp, HubSpot, Buffer, and Hootsuite. Platforms like Grow with Google offer professional certificates in Digital Marketing and E-commerce, with more than 70% of U.S. graduates reporting benefits like new jobs or promotions. These resources not only teach you practical skills but also reinforce the resourceful mindset needed for bootstrapping.

Another must-have skill is web design. DIY platforms like Wix and WordPress make it easy to create professional websites without hiring a developer. For extra guidance, Coursera provides free guided projects that can help you design a site quickly and affordably. If you're ready to dive deeper, Meta’s "Introduction to Front-End Development" course, which has a stellar 4.8/5 rating from over 14,000 reviews, covers the basics of HTML, CSS, and React.js.

Financial management is equally important. Learn to track cash flow, budget effectively, and forecast your finances using basic accounting tools. Many simple accounting software options and online banking platforms can give you daily updates on your receivables and payables, helping you stay focused on reaching your breakeven point.

As John Hall, Co-founder and CEO of Influence & Co., wisely noted:

"I thought I needed an attorney for everything. If you educate yourself about legal issues in your industry, you will know when you do need to include an attorney - and save a lot of money in the meantime".

5. Pick a Low-Cost Business Model

Starting a business doesn't have to drain your savings. In fact, many businesses begin with just $100 to $5,000, making it possible to launch with minimal upfront costs.

Service-based businesses are a great starting point if you have marketable skills. Freelancing, virtual assistance, and consulting allow you to use your expertise - whether in writing, design, or development - to start earning quickly. These models don't require inventory or warehouse space, keeping your expenses low.

For those interested in e-commerce, dropshipping is a smart way to save on costs. By outsourcing inventory and fulfillment, you can avoid the expense of stocking products. However, it’s worth noting that as your business grows, supplier reliability might become a challenge.

Digital content creation is another low-risk option. Selling ebooks, creating online courses, or starting a blog can generate scalable income with minimal overhead. Plus, forming a Limited Liability Corporation (LLC) for added legal protection is surprisingly affordable in many states - often costing less than $100 when done online.

The key is aligning your business model with the resources you already have. Consider your skills, time availability, and the ability to work from home or part-time. As entrepreneur and business advisor Murray Newlands puts it:

"Sticking closely to what you know not only means you will avoid investing time or money upskilling, but you also won't have to spend any of your startup savings paying for high cost consultant fees".

6. Work from Home to Cut Costs

Office space often ranks among the biggest expenses for startups, sometimes costing thousands before you even land your first customer. But here's the good news: you can entirely sidestep this expense by working from home.

Some of the most iconic companies - Amazon, Apple, and Disney - started in garages and home offices before scaling into global powerhouses. Thanks to modern technology, running a professional business from your home has never been easier. As Rieva Lesonsky, CEO of GrowBiz Media, puts it:

"Technology has made it easier than ever to operate most businesses from home. You'll save on office space and overhead, and cut commuting time so you have more hours to dedicate to your business".

Working from home doesn’t just eliminate rent - it also trims down utility bills, cleaning costs, and maintenance expenses. Plus, a home office can qualify for tax deductions on things like internet, utilities, and even a portion of your mortgage interest. These savings can be redirected into areas that matter, like developing your product or marketing, instead of lining a landlord's pockets. If you occasionally need a more formal setting for meetings, there are flexible options to explore.

For example, co-working spaces can provide professional meeting areas on an as-needed basis, so you’re not locked into a costly long-term lease. Murray Newlands, an entrepreneur and business advisor, underscores this point: "Startups think they need an office right away to be legitimate. That couldn't be farther from the truth". Just make sure to check with your local zoning commission to confirm there are no restrictions on running a business from your home.

7. Use Your Personal Assets

Before diving into expenses for new equipment or hiring outside help, take a moment to evaluate what you already have. Your personal assets - whether financial, physical, or skill-based - can be the backbone of your business, saving you from the need for loans or pitching to investors. Think about how existing tools, your expertise, and available resources can jumpstart your venture.

Start with technology you already own. That old laptop, your smartphone, and your home internet connection might be all you need to handle early IT requirements without costly upgrades. For instance, Mark Zuckerberg launched the first version of Meta (then Facebook) in 2004 using nothing more than the resources available in his college dorm room. Similarly, Jeff Bezos began Amazon in 1995 from his garage, using the space to sell and ship the company’s first book.

Next, lean on your skills. As Murray Newlands points out:

"Sticking closely to what you know not only means you will avoid investing time or money upskilling, but you also won't have to spend any of your startup savings paying for high cost consultant fees".

Take stock of your physical and financial assets. This could include savings, certificates of deposit, or even retirement accounts. Rieva Lesonsky, CEO of GrowBiz Media, advises:

"Assess your financial resources, such as savings, certificates of deposit or even retirement accounts. Do you have cars, collectibles or other items of value you could sell to raise startup capital?".

There’s also value in resourcefulness. Nick Woodman, founder of GoPro, used his mother’s sewing machine to create early prototypes for the camera’s wrist straps. He even borrowed $35,000 from her to help fund the company’s initial operations.

Finally, consider trading your expertise with other entrepreneurs to fill gaps without spending money. For example, you could exchange marketing advice for IT support or swap photography services for website design. This approach allows you to secure the resources you need while keeping your cash flow intact.

8. Negotiate with Vendors and Control Spending

Every dollar you save when working with vendors directly improves your bottom line. Suppliers are usually open to negotiation, especially when they see you as a long-term partner.

Start by gathering at least three competitive bids to strengthen your position when negotiating with your preferred vendor. If a supplier isn't willing to lower their unit price, explore alternative benefits like free shipping, extended warranties, or flexible payment terms ranging from 30 to 90 days. Michael Glauser, Executive Director of the Clark Center for Entrepreneurship at Utah State University, highlights the importance of trade credit:

"Obtaining 30 to 90 days of trade credit is the best business loan you can get".

Once you've secured favorable terms with your vendors, shift gears and take a closer look at your overall spending. Regularly audit your expenses by reviewing profit-and-loss statements each month to spot unnecessary costs. Aim to keep your overhead below 35%. Cut back on non-essential purchases, such as unused software subscriptions, excessive office supplies, or equipment that doesn't add value. A great example of this is Han-Gwon Lung and Dan Foley, who launched their copywriting agency, Tailored Ink, with just $1,000. By embracing extreme frugality - Lung even slept on a $25 inflatable bed and used a $300 desktop - they reinvested nearly all their earnings and scaled the business to nearly $1 million in revenue within two years, all without incurring debt or seeking outside funding.

You can also stretch your savings further by exploring alternative ways of exchanging value. Barter your skills or services with other business owners to save cash. For instance, trade web design services for accounting help or exchange marketing advice for IT support. Another option is to collaborate with other small businesses to form group purchasing arrangements, giving you access to bulk discounts that wouldn't be available otherwise. The bottom line? Treat every expense as negotiable and see every vendor relationship as a chance to secure better terms.

9. Write a Clear Business Plan

When you're bootstrapping, your business plan doesn't need to be a lengthy document. In fact, a lean startup plan can be as short as a single page and take just about an hour to draft. The goal is to create a clear, focused roadmap that outlines your vision and priorities. Stick to the essentials: value proposition, target customers, revenue streams, cost structure, and key activities.

Think of your business plan as a "living document" - something you revisit and update regularly based on market feedback. Tim Berry, Chairman of Palo Alto Software, sums it up perfectly:

"Strategy is focus. Focus on what you do really well and on the people who really care about what you do really well".

This mindset helps you avoid wasting time and resources on customers or strategies that don’t align with your strengths.

Here's an important stat: founders with a written plan grow 30% faster. A well-thought-out plan helps you identify potential roadblocks and spot new opportunities. If you're not seeking outside investment, you can skip elements like executive summaries or exit strategies. Instead, treat your plan as a management tool - something to guide your decisions rather than sell your business.

Make it a habit to review your plan monthly. Compare it against your actual results to see where your sales forecasts fell short and why. Adjust your approach as needed. Break your goals into smaller, actionable milestones with clear deadlines and responsibilities. This keeps you accountable and ensures you're consistently moving forward, even with limited resources.

If you're not sure where to start, free tools like the U.S. Small Business Administration's templates, SCORE's resources, or Zapier's Simple Business Plan Template can help. The key is to start writing - don't worry about perfection. Even a rough draft is better than having no plan at all.

10. Save Money for Personal Expenses

While keeping your business costs low is important, protecting your personal finances is just as critical for long-term success.

Before diving into bootstrapping full-time, aim to save at least six months' worth of living expenses. This financial cushion allows you to focus on building your business without the constant stress of figuring out how to cover rent or groceries.

In the early stages, you might not draw a salary for months - or even years - because most of the revenue will likely go back into growing the business. Jeremy Miller, Co-founder and CEO of Label, puts it best:

"Think of your business as a savings account. People always say 'Save six months' worth of expenses in case you lose your job one day,' and you need to treat your business the same way."

Take a hard look at your spending. Cancel subscriptions you don’t use, cut back on takeout, and avoid unnecessary purchases. If possible, consider staying at your current job a bit longer or working part-time while you get your business off the ground. Some founders even move in with family or rent out a spare room to reduce housing costs.

Having a solid savings buffer can make all the difference during those lean months, as many early-stage entrepreneurs have learned.

Conclusion

Bootstrapping requires a mindset shift that centers on resourcefulness, tight financial management, and starting small. Dario Markovic, CEO of Eric Javits, captures the essence of this approach:

"Bootstrapping is a strategy where entrepreneurs start and grow a business using their funds or revenue from the company. It's a self-starter method emphasizing sustainability, independence and creative problem-solving".

The numbers speak volumes: over 80% of new businesses are self-funded, while venture capital supports a mere 0.05%. This highlights how self-reliance serves as a cornerstone for most entrepreneurs. When you're funding your dream with your own money, every dollar takes on added significance.

Success in bootstrapping goes beyond just managing finances - it thrives on disciplined budgeting, leveraging networks, and embracing gradual, informed growth. Adaptability and a commitment to continuous learning are equally critical. Jim Beach, Founder of InternationalEntrepreneurship.com, explains:

"Slow, steady growth is preferable to fast, explosive growth... Growing organically is maybe not as sexy, but it's more likely to produce a company with no debt that is able to weather recessions and crises".

The journey of starting from scratch demands resilience and ingenuity. Martin Zwilling, CEO of Startup Professionals, offers a valuable perspective:

"A limited budget can be viewed as your biggest constraint, or as an incentive to do things more creatively. With startups, there is a big premium on creativity and innovation".

For those ready to take the leap and build their vision from the ground up, FromZeroToGrow is a resourceful platform offering practical advice, inspiring success stories, and actionable strategies to keep you motivated and focused on your entrepreneurial path.

FAQs

What are the key benefits of bootstrapping a business?

Bootstrapping a business means funding your venture using your own savings, early revenue, or internal resources rather than relying on loans or outside investors. This method pushes you to operate lean, think creatively, and manage finances with discipline - all while keeping full control of your business.

Here are some of the standout advantages:

- Complete ownership and control: You retain 100% equity, giving you the freedom to make decisions without needing approval from external investors.

- No debt or interest payments: Skipping loans reduces financial risk and lets you reinvest profits directly into growing your business.

- Quick decision-making and flexibility: Without a board of investors to consult, you can adapt to market changes and make strategic moves faster.

At FromZeroToGrow, we believe bootstrapping lays the groundwork for a resilient, self-driven business that evolves on your terms.

What’s the best way to test my business idea using a Minimum Viable Product (MVP)?

Testing your business idea with a Minimum Viable Product (MVP) means creating the simplest version of your product that delivers its main value. The goal is to gather feedback from actual users and confirm that your idea works before investing heavily in development. Stick to solving one major problem and include only the most necessary features. This approach keeps costs low - often under $10,000 - and development time short, typically just a few weeks.

Once your MVP is ready, share it with a small group of early adopters. These could be friends, industry contacts, or users you reach through affordable ads. Pay close attention to how they interact with the product. What do they enjoy? Where do they struggle? Gather both quantitative data (like sign-up numbers or usage patterns) and qualitative feedback (through surveys or interviews) to see if your idea is hitting the mark. Use this input to fine-tune your product and only add features when there’s clear demand.

It’s important to note that an MVP isn’t a “half-done” product - it’s a tool for learning. By testing early and refining based on real feedback, you’ll reduce risks, save money, and set the stage for growing your business successfully.

What are some effective ways to manage cash flow when bootstrapping a business?

Managing cash flow is a top priority for any bootstrapped business since you're working without the cushion of external funding. The first step? Forecast your expenses and income for the next 3 to 12 months. This gives you a clear picture of what’s ahead, helping you plan for payroll, supplier payments, and customer invoices.

When it comes to invoicing, speed and strategy are your best friends. Send invoices to clients right away, consider offering small discounts for early payments, and stay on top of overdue accounts with consistent follow-ups. On the flip side, try to negotiate longer payment terms with vendors to create breathing room between the cash you’re bringing in and the cash you’re sending out.

Keep your spending tight by trimming unnecessary costs, opting for free or budget-friendly tools, and holding off on non-essential purchases until your revenue is more predictable. It’s also smart to build a cash reserve - enough to cover at least one month of operating expenses - for unexpected situations. Regularly track key metrics like your cash-in vs. cash-out flow and burn rate to catch any red flags early. By staying disciplined and creative, you can keep your cash flow steady and set your business up for sustainable growth.