9 Stories of Financial Independence Success

Explore inspiring stories of financial independence, highlighting strategies for debt elimination, investing, and frugality to achieve true freedom.

Financial independence is about having enough savings, investments, and passive income to cover your living expenses without relying on a traditional job. This article shares nine real-life stories of individuals who achieved financial freedom through smart strategies like debt elimination, investing, and frugality. From tackling student loans to turning passions into income, these stories prove that consistent effort and planning can lead to financial security.

Key Takeaways:

- Debt Elimination: Sarah paid off student loans by cutting expenses and freelancing.

- Skill Building: Raj transitioned to a tech career, increasing his income and savings.

- Entrepreneurship: Fernandez Paulino and Torres turned skills into profitable businesses.

- Investing: David combined index funds and rental properties for passive income.

- Frugality: Shang Saavedra adopted minimalism to save and invest more.

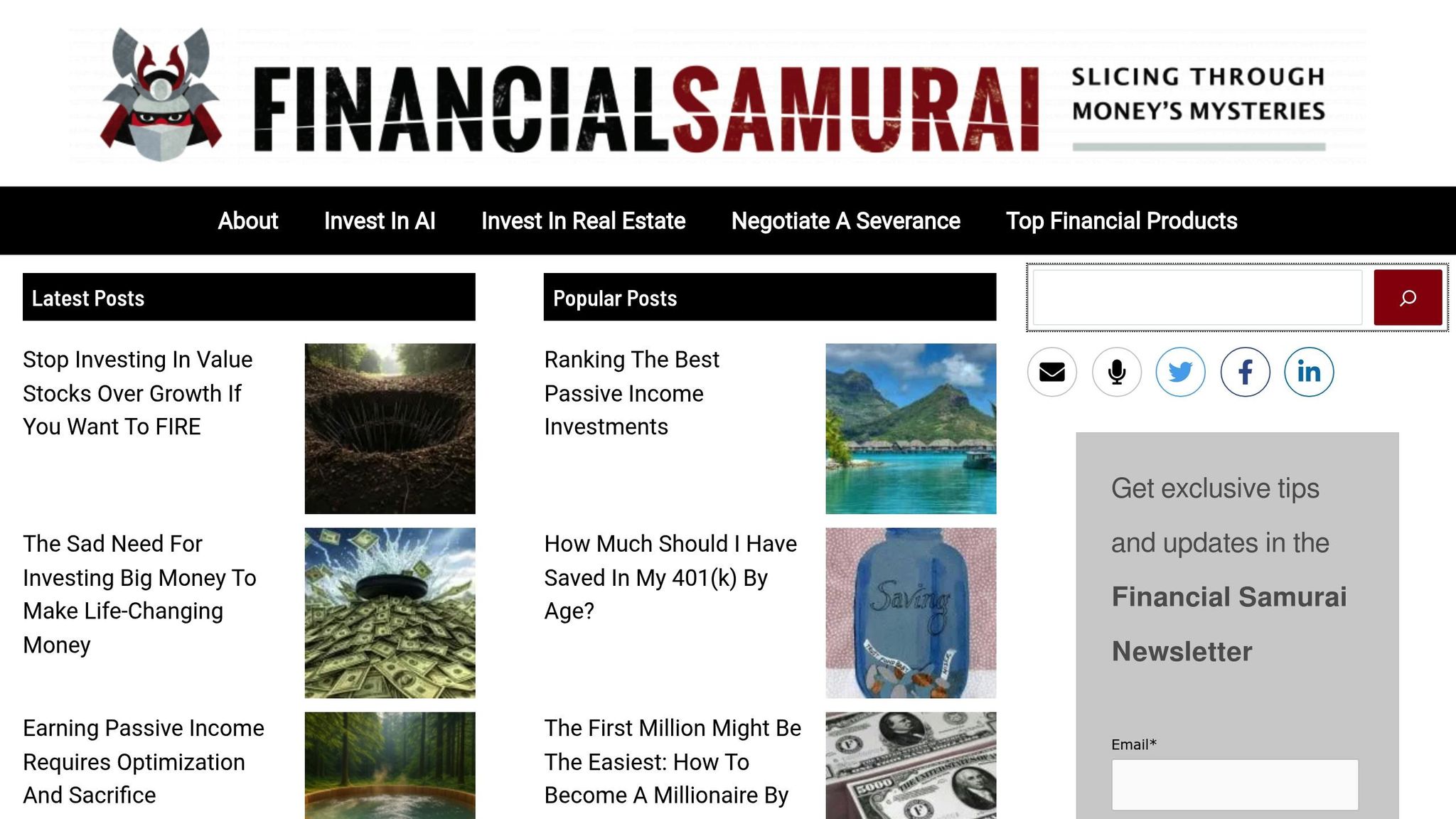

- Diversified Income: Freedom Thirty Five and Financial Samurai created multiple income streams.

Action Steps:

- Track your spending and cut unnecessary costs.

- Pay off high-interest debt first.

- Maximize tax-advantaged accounts like 401(k)s and Roth IRAs.

- Create additional income streams using your skills.

- Automate savings and investments.

- Build an emergency fund covering 3–6 months of expenses.

No matter your starting point, these stories show that financial independence is achievable with discipline and clear goals.

What Financial Independence Means

What is Financial Independence?

Financial independence is about having enough savings, investments, and passive income to cover your living costs without relying on a traditional job. It’s about creating a financial cushion where your investments generate enough returns to sustain your lifestyle.

But here’s the thing - it doesn’t mean you have to stop working. Many financially independent people continue working, but they do it because they want to, not because they have to. The real benefit is the freedom to choose how you spend your time.

Reaching financial independence gives you the flexibility to make decisions based on your goals, not just your bills. You could take a career leap, dive into a passion project, or simply enjoy the peace of mind that comes with economic security.

A common guideline for achieving financial independence is saving 25 times your annual expenses. For example, if your yearly expenses are $40,000, you’d need about $1 million invested to maintain that lifestyle through investment returns.

This idea forms the foundation of the FIRE movement, which we’ll dive into next.

The FIRE Movement

The FIRE movement - short for Financial Independence, Retire Early - has gained a lot of attention in the U.S. over the past decade. It’s all about saving and investing aggressively to reach financial independence long before the traditional retirement age of 65.

FIRE followers aim to save 50%–70% of their income, far above the national average. They focus on increasing their earnings, cutting unnecessary expenses, and investing the difference in low-cost index funds or other growth-focused investments.

There are three main approaches within the FIRE movement:

- Lean FIRE: For those aiming for a simpler lifestyle, requiring $500,000 to $1 million in savings.

- Fat FIRE: For those who want a more luxurious retirement, typically needing $2.5 million or more.

- Barista FIRE: A middle ground where partial financial independence is achieved, supplemented by part-time work.

Beyond the numbers, the FIRE movement emphasizes intentional living. By trimming unnecessary expenses and focusing on what truly matters, many followers find that they not only speed up their journey to financial independence but also improve their overall quality of life.

Key Financial Tools in the U.S.

Americans have access to several financial tools that can help fast-track their path to financial independence. Using these tools effectively can be the difference between retiring at 65 and achieving financial freedom decades earlier.

- 401(k) Plans: These employer-sponsored accounts are a cornerstone of retirement planning for many. In 2024, you can contribute up to $23,000 annually, and many employers match a portion of your contributions - essentially free money. Contributions also lower your taxable income, making them a smart way to save.

- Roth IRAs: These accounts are particularly valuable for younger investors. You can contribute up to $7,000 annually with after-tax dollars, and all growth and withdrawals in retirement are tax-free. Plus, you can withdraw your contributions (but not earnings) at any time without penalty, giving you added flexibility for emergencies.

- Health Savings Accounts (HSAs): HSAs offer a triple tax advantage - contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. After age 65, you can even use the funds for non-medical expenses, making HSAs a versatile tool for retirement planning.

- Budgeting and Investment Apps: Tools like Mint help you track spending, while platforms like Vanguard and Fidelity make it easy to invest in low-cost index funds with expense ratios as low as 0.03%. These apps simplify the process of managing your finances and staying on track toward your goals.

To maximize your financial growth, prioritize tax-advantaged accounts like 401(k)s, Roth IRAs, and HSAs before moving on to taxable investments. This approach not only reduces your tax burden but also lets your money grow faster through the power of compounding.

Stories of Regular People Who Achieved Financial Freedom

9 Financial Independence Success Stories

These nine inspiring accounts showcase how individuals from different walks of life reached financial independence through determination, discipline, and smart decisions. Each story highlights a unique strategy for overcoming financial challenges, proving that consistent effort and thoughtful planning can lead to financial freedom. These real-life examples show how saving intentionally and making wise investments can pave the way toward independence.

Sarah: Tackling Student Debt and Building Wealth

After graduating, Sarah found herself buried in student debt and starting a career with a modest income. To tackle her financial hurdles, she made intentional choices: living in shared housing to cut costs, cooking at home instead of dining out, and starting a freelance graphic design business for extra income. She directed every spare dollar toward paying off her loans, erasing her debt faster than expected. Once debt-free, she shifted her focus to saving and investing in retirement accounts and low-cost index funds. Sarah’s journey proves that small sacrifices today can create big opportunities tomorrow.

Raj: Reaching FIRE Through a Career Change

Raj started his career in retail, earning just enough to get by. After discovering the FIRE (Financial Independence, Retire Early) movement, he realized his current path wouldn’t secure his future. Determined to change course, he took free online web development courses while working full-time, building a portfolio of projects on the side. His hard work paid off when he transitioned into a higher-paying tech job. By keeping his expenses low and saving a significant portion of his new income, Raj fast-tracked his journey to financial independence. His story shows how upgrading your skills can completely alter your financial path.

Fernandez Paulino: Clearing Loans Through Entrepreneurship

After graduate school, Fernandez Paulino faced hefty student loans and a tough job market. Instead of waiting for an opportunity, he created one by launching an online tutoring business. Using his strength in mathematics, he started with competitive rates and increased them as his reputation grew. By keeping personal expenses low and reinvesting in his business, Fernandez paid off his loans in just a few years. His story highlights how turning your skills into a business can be a powerful way to eliminate debt and build a solid financial foundation.

Torres: Turning a Food Blog into Financial Recovery

When Torres faced mounting credit card debt due to unexpected expenses, she turned to her passion for cooking. She started a food blog focusing on budget-friendly recipes and meal planning. What began as a hobby quickly gained traction, generating income through affiliate marketing, sponsored posts, and digital products. Torres used every dollar from her blog to aggressively pay down her debt. Eventually, she cleared her balances and built a more secure financial future. Her experience shows how creativity and passion can lead to financial solutions.

David: Building Wealth Through Investments

David started his financial independence journey with modest savings but big ambitions. He aggressively saved, invested in low-cost index funds, and ventured into rental property. By living modestly and reinvesting the passive income from his investments, David reached his financial goals within his planned timeline. His story demonstrates how combining different investment strategies can create multiple streams of income and accelerate financial independence.

Shang Saavedra: Minimalism as a Path to Financial Freedom

Shang Saavedra embraced minimalism to take control of her finances. She downsized her living space, sold unnecessary belongings, and relied on public transportation to cut expenses. The money she saved was consistently invested in a diversified portfolio. Her lean lifestyle and commitment to investing allowed her to achieve financial independence at a young age. Shang’s journey shows how simplifying your life can lead to financial success.

Freedom Thirty Five: Mixing Real Estate with Investments

The creator of the Freedom Thirty Five blog built a diversified portfolio by combining real estate investments with dividend-paying stocks and REITs. Starting with limited resources, they purchased affordable, cash-flowing rental properties while also focusing on long-term dividend growth. Over time, these passive income streams covered their living expenses. Their approach underscores the value of diversifying income sources to achieve financial independence.

Financial Samurai: High Income Meets Hustle

The founder of the Financial Samurai blog proved that even a high salary can be boosted through side hustles. While working in a well-paying career, he took on freelance consulting and created online courses to diversify his income. By prioritizing essential spending and eliminating unnecessary expenses, he was able to invest heavily without sacrificing his quality of life. His strategy shows that combining a strong primary income with side hustles can significantly speed up wealth accumulation.

These stories demonstrate that regardless of where you start, focused actions and smart strategies can turn financial challenges into stepping stones for success.

Methods and Lessons from Real-Life Stories

The experiences of these individuals offer practical strategies that work across various income levels, combining multiple approaches to achieve financial independence.

Key Methods for Success

One effective strategy is aggressive debt elimination. Both Sarah and Fernandez Paulino tackled substantial debt by channeling every available dollar toward repayment. This approach not only creates momentum but also frees up funds for future financial goals.

Diversifying income streams proved to be another game-changer. Torres turned her love for cooking into multiple revenue sources through affiliate marketing and sponsored content. Raj’s career shift from retail to tech highlights how skill-building can significantly increase earning potential. Similarly, the founder of Financial Samurai expanded his income by combining consulting with online courses.

Some individuals prioritized frugality without compromising quality of life. Shang Saavedra adopted minimalism and used public transportation, while David maintained a modest lifestyle even as his investment income grew. Their stories demonstrate how cutting expenses in ways that align with personal values can accelerate progress.

When it comes to investments, a balanced approach stood out. David invested in both index funds and rental properties, while Freedom Thirty Five diversified with REITs and dividend stocks. These strategies show how blending different investment options can create reliable streams of passive income.

While the average American saves just 8% of their income - making retirement a decades-long process - these individuals achieved much higher savings rates. For example, saving 50% of one’s income can reduce the time to retirement to just 17 years.

| Method | Pros | Cons |

|---|---|---|

| Aggressive Debt Payoff | Quick progress, frees up future income | Requires sacrifices, may delay investing |

| Side Hustles | Extra income, skill-building, scalable | Time-consuming, uncertain returns |

| Extreme Frugality | Rapid cost reduction, clarifies priorities | Risk of burnout, potential social impact |

| Real Estate Investing | Passive income, tax advantages, inflation hedge | High entry costs, requires management |

| Index Fund Investing | Low fees, diversified, hands-off approach | Market fluctuations, needs patience |

These strategies laid the groundwork for overcoming challenges along the way.

Getting Past Challenges

While employing these methods, individuals also had to navigate common obstacles.

For example, student loan debt was a shared hurdle. Many used shared housing and entrepreneurial ventures to view loans as temporary setbacks rather than permanent barriers. They also avoided falling into the trap of lifestyle inflation, which often leads to prolonged debt cycles.

Career instability and low starting incomes posed additional challenges. Instead of giving up, these individuals used setbacks as opportunities to gain new skills and find additional income sources, proving that current circumstances don’t define future potential.

Family responsibilities and societal pressures to spend also clashed with their goals. By identifying their personal motivations - whether it was spending more time with family, traveling, or gaining career flexibility - they stayed focused on their long-term objectives.

Market volatility was another test, but they responded by increasing their savings rates and carefully managing expenses. Their experiences highlight that consistency matters more than perfection when pursuing financial independence.

The rule of 25 - saving 25 times one’s annual expenses - served as a guiding principle for many, with some exceeding this target for added security. Considering the average American carries nearly $24,000 in non-mortgage debt and over $104,000 when including mortgages, breaking free from traditional spending habits can unlock financial opportunities that once seemed unattainable.

These challenges emphasize the power of a disciplined financial mindset. Through sacrifice, discipline, and steady action, financial independence becomes achievable. The sense of control and peace of mind that comes with financial freedom remained a powerful motivator throughout their journeys.

Steps You Can Take for Your Financial Journey

Achieving financial independence is within reach if you take consistent action and make thoughtful choices. Here are some practical steps to kickstart your journey today.

Step-by-Step Actions

Track every dollar - just like Sarah, who discovered she was spending $400 a month on dining out. By identifying this expense, she redirected those funds toward paying off debt. Tools like Mint or YNAB can make this process easier, or you can stick to a simple spreadsheet to monitor your spending habits.

Focus on paying off high-interest debt first. Whether you use the debt avalanche or snowball method, tackling these debts can save you thousands in interest. For example, Fernandez Paulino paid off $23,000 in student loans by channeling every extra dollar toward her highest-interest loans, building momentum for her next financial milestones.

Take advantage of your employer’s 401(k) match. If your employer offers a match, contribute enough to get the full benefit - it’s essentially free money. David started small, contributing 3% of his salary and increasing it by 1% each year until he reached 15%. This gradual approach made the process manageable and helped him grow his wealth steadily.

Create additional income streams. Torres turned her love for cooking into affiliate marketing revenue. You can do the same with skills you already have - try freelance writing, tutoring, pet sitting, or selling items online. Even an extra $200 a month can make a big difference in reaching your financial goals.

Automate your investments. Set up automatic transfers to index funds or ETFs every payday. This removes emotions from the equation and ensures consistency. Shang Saavedra automated 50% of her income into investments, treating savings as a non-negotiable expense. This strategy helps curb lifestyle inflation while keeping you on track.

Build an emergency fund. Aim to save three to six months’ worth of expenses before diving into aggressive investments. Store this money in a high-yield savings account where it’s accessible but separate from your everyday accounts.

Consider adding real estate to your portfolio. Start with REITs (Real Estate Investment Trusts) through your brokerage account or explore rental properties when you’re ready. Freedom Thirty Five began with REITs before transitioning to rental properties, gaining real estate exposure without the upfront costs and management challenges of direct ownership.

These steps highlight the importance of consistent saving, mindful spending, and disciplined execution - key principles echoed in countless success stories.

How FromZeroToGrow Can Help

Pair these steps with the resources offered by FromZeroToGrow to stay motivated and informed throughout your financial journey.

The blog shares real success stories from people who’ve overcome challenges like student loans, career changes, or even bankruptcy. These relatable examples provide actionable steps you can apply to your own situation.

Practical growth tips cover everything from maximizing your savings rate to building the mental discipline needed for long-term success. Founder Ivens Plaisir offers insights into the thought processes that set financially independent individuals apart from those who struggle to make progress.

Stay connected with the email newsletter, which delivers fresh strategies and success stories straight to your inbox. This regular update helps you maintain momentum, especially during times when motivation might dip.

Engage with a supportive community of like-minded individuals who are pursuing similar goals. Sharing experiences and receiving encouragement from others on the same path can provide accountability and help you push through challenges.

FromZeroToGrow emphasizes mindset and discipline - two critical factors that consistently drive success. The blog avoids vague motivational content, focusing instead on actionable strategies you can use right away.

With free blog content and subscription options that grant full access to all resources and newsletters, FromZeroToGrow offers an affordable way to invest in your financial education. This combination of proven strategies, educational content, and community support creates the perfect foundation for achieving your financial independence goals through steady, consistent effort.

Conclusion: Start Your Financial Independence Journey

The nine stories you've explored show that achieving financial independence is possible for anyone willing to make consistent choices and stay persistent over time. For example, Sarah took control by tracking her spending and cutting out waste. Raj adopted FIRE principles to shape his career on his own terms. Meanwhile, Lisa rebuilt her financial life after bankruptcy and reached an impressive $800,000 net worth. Each of these journeys highlights a determination to tackle financial obstacles head-on.

There’s no universal "right way" or strict timeline for reaching financial freedom. It all depends on factors like your income, expenses, debt, savings rate, and lifestyle. What truly matters is taking that first step and sticking with it. The FIRE movement has shown that financial independence in your 40s or 50s is entirely achievable. Even if retiring early isn’t your ultimate goal, the principles behind these stories can guide you toward greater financial security and peace of mind.

If you're ready to begin your own journey, start by tracking your spending and identifying areas to cut back. Set a clear monthly savings target - many people find the 50/30/20 rule helpful: allocate 50% of your income to needs, 30% to wants, and 20% to savings or paying off debt. Building an emergency fund with three to six months of living expenses is also crucial to protect yourself from unexpected financial shocks.

Define your goals in a way that’s specific, realistic, and tied to a timeline. Whether it’s buying a home, gaining more career flexibility, or retiring early, make sure your goals align with your personal aspirations. At its core, financial independence means being in charge of your money - where your income, savings, and investments provide for your needs and dreams, freeing you from constant financial stress.

FAQs

How can I work toward financial independence if I have a low income and significant debt?

Starting your path to financial independence when you're working with a low income and high debt can feel overwhelming, but it’s absolutely doable with the right plan. The first step? Create a realistic budget that focuses on covering the basics and cutting out unnecessary expenses. This will help you see exactly where your money is going and where you can make adjustments.

When it comes to tackling debt, consider methods like the debt snowball, which involves paying off your smallest debts first to build confidence and momentum. Alternatively, the debt avalanche approach targets high-interest debts first, saving you more money in the long run. Choose the strategy that feels most motivating to you.

Increasing your income can also make a big difference. Whether it’s picking up a side hustle, freelancing, or even selling items you no longer need, aim to channel any extra cash toward your financial goals. Once you’ve made progress on your debt, start setting aside money for an emergency fund and explore small, consistent investments to grow your savings over time.

The key is sticking to your plan with patience and determination. Even small steps, taken consistently, can lead to big changes in your financial future.

What are some effective ways to earn extra income while keeping my full-time job?

Balancing a full-time job while finding ways to diversify your income is entirely doable with the right plan. A great place to start is by tapping into the skills you already have. For example, you could explore freelancing opportunities in areas like writing, graphic design, or consulting. Platforms like Fiverr or Upwork make it easier to connect with clients and take on projects that fit around your work schedule.

You might also want to explore passive income options. This could mean selling digital products like e-books, templates, or even creating an online course that showcases your expertise. Investing in things like rental properties or dividend-paying stocks can also generate steady income over time without requiring daily involvement.

By blending these approaches, you can create additional income streams, strengthen your financial foundation, and still keep your primary job intact.

How can I choose the right financial independence strategy, like Lean FIRE or Fat FIRE, based on my goals and lifestyle?

Choosing Between Lean FIRE and Fat FIRE

Deciding between Lean FIRE and Fat FIRE comes down to your retirement goals, lifestyle preferences, and current financial situation. The first step? Figure out how much you expect to spend annually in retirement and how much you're willing to adjust your current lifestyle to achieve those goals.

- Lean FIRE is a great fit for those who embrace a minimalist lifestyle, keeping annual retirement expenses under $40,000. This approach prioritizes frugality, cutting costs, and living simply to achieve financial independence on a smaller budget.

- Fat FIRE, on the other hand, is for those who envision a more comfortable retirement, with yearly expenses around $150,000 or more. This path requires aggressive saving during your working years to build the financial cushion needed for greater flexibility and freedom later.

The choice ultimately hinges on your values, savings habits, and vision for what financial independence looks like for you.