Side Hustle vs Full-Time Job: Which to Choose

Explore the differences between side hustles and full-time jobs to find the best fit for your lifestyle and financial goals.

Can't pick between a side gig or a full-time job? Here's what you need to know:

- Full-time jobs are stable. Think steady money, health care, and a clear job path. But, they often need set hours and cut down on free time.

- Side gigs are flexible. You choose your hours, make extra cash, and might grow it big. But, cash flow is not sure, and often no perks like holiday pay or savings plans.

Quick Summary:

- Time Needed: Full-time jobs take about 40 hours a week; side gigs are more open.

- Money: Full-time jobs pay you regular; side gigs can change but might grow.

- Perks: Full-time jobs give extras; side gigs usually don’t.

- Risk: Full-time jobs are safer; side gigs mean unsure money.

Final Thought: What you pick depends on what you want - sure thing or more free will, set pay or chance to make more. Many mix both for the best of each.

The Truth about Full-Time Jobs (when you have a side hustle)

Key Ways Side Hustles and Full-Time Jobs are Not the Same

When you know how side hustles and full-time jobs are not the same, you can see what your choices are. These two ways of working do not match up much in terms of time needed, money made, and chances to grow.

Time Needed and Keeping Life in Balance

Full-time jobs take a lot of your time, often 40 or more hours each week. Your boss sets your hours, so free time can be hard to find.

Side hustles are more often part-time, letting you choose when you work. This choice lets you put personal things first and fit work into your life, not the other way around.

It’s good to note that over 70% of folks in America are looking for ways to make more money, and about 31% of workers in the U.S. have a side job along with their main job. As Andreas Jones, who started Kinda Frugal, says:

"Balancing a full-time job with a side hustle isn't just about making extra money - it's about creating opportunities, securing financial freedom and designing a life that aligns with your goals."

In the end, the main thing that sets them apart is control: side jobs let you pick when and how you work, while full-time jobs stick to a strict plan. Now, let's look at how they stack up in terms of money.

Stable Money and Money Perks

Talking money, each path gives a very different feel. Full-time jobs give steady pay and extras, like health care, money plans for later life, and paid days off. This sureness makes it simple to plan and think ahead.

On the other hand, side jobs have pay that changes but can go up over time. On most days, side job folks make about $1,215 each month, and there’s no cap if your small show grows big.

Though full-time jobs bring sure money and perks, side jobs can lead to big earnings but often don't have good things like health care or paid off days.

Being Free and Chances to Grow

Being free to choose and growth chances matter a lot when picking a path. Side jobs let you choose your hours, be it early day, late night, or weekends. But full-time jobs often have set hours, giving you less choice.

Chances to grow vary too. Full-time jobs usually offer a clear way up, like higher roles and more pay. But side jobs give you chance to build your own thing, letting you take more clients, ask for more money, or try new things.

Real stories show these differences. For example, Sarah Mitchell set up an Etsy shop for jewelry while being a marketing boss. In two years, her shop made more money than her day job, letting her focus on her business full time. Also, James Carter, an IT helper, makes an extra $2,000 a month by doing freelance graphic work, which helps him save while keeping his main job safe.

Side by Side Look

| Part | Side Work | Full Job |

|---|---|---|

| Time Needed | Changes (often not full-time) | 40 or more hours each week |

| Plan Control | Full control over hours | Set hours by boss |

| Money Sureness | Mix, on average $1,215/month | Steady money |

| Perks | Not many | Health care, time off, saving plans |

| Grow Chances | Earn as much as you can | Steady upgrades and more money |

| Money Risk | More risk, shifting money | Less risk, fixed money |

| Life-Work Mix | A lot of freedom | Less freedom due to set hours |

| Work Growth | Own boss growth | Move up inside the firm |

This chart makes it clear: the best pick rests on what you think is key. If you want cash safety and perks the most, a full-time work may be best. But, if you like to set your hours and aim for more money, a side job may be just right.

Good and Bad of Each Choice

Let's look at the good and bad sides of every choice, checking how they help or hurt your cash and job growth.

Side Jobs: The Ups and Downs

Good Sides of Side Jobs

Side jobs let you pick when you work. If you wake up early or stay up late, you can plan work to fit your day, not the other way around. Also, you can earn as much as you want. The more you work and the better you get, the more cash you'll have. It's a solid way to do what you love without needing it to pay all your bills .

"A side hustle allows you to be creative and follow your passion. It's a chance to do something you love without the pressure of making it your full-time job." - Athirah Syamimi, Writer

Another good thing? Having more than one way to make money. If one way stops, there are others to use instead. This is key since 39% of people in America run side jobs or work on their own.

Side Job Issues

The bad part? Money can change a lot, from one month to the next, making it hard to plan your money needs . Also, keeping up a side job and a main job needs a lot of time planning and self-rule. Without it, you could get very tired .

And don't look for the usual job goods. Side jobs usually don't offer things like health care, paid sick days, or money for later years .

Jobs All Day, Good and Bad

Good in Full-Time Jobs

A full-time job brings a steady setup. You get sure money, which helps with making plans for spending and the future. Plus, things like health care, paid days off, and plans for later add big value.

These jobs often have a set path for moving up, with clear ways to get promoted and programs to learn more, paid by your boss. And don't forget set work hours, which can make life balance better.

Bad in Full-Time Jobs

Yet, full-time jobs also have issues. Set money often means you can't make more, even if you work harder. Being able to change your hours can be hard too - it usually needs a yes and depends on work rules.

While jobs like these may seem safe, cuts or being let go are still risks to think about. And for some, not getting new things to do can make work feel dull or even lead to getting very tired.

Looking at Both Sides

| Aspect | Side Hustle Pros | Side Hustle Cons | Full-Time Job Pros | Full-Time Job Cons |

|---|---|---|---|---|

| Money | Can earn a lot | Pay can go up and down | Set pay every month | Pay does not go beyond a point |

| Perks | You make the rules | No job perks like paid time off | You get good job perks | Perks depend on the job |

| Time | Work when you want | Often work more, can feel too much | Set work times | Can't pick your hours |

| Growth | Can try many new things | Must pay to learn more skills | Career path set by the job | Can get stuck in the same spot |

| Safety | Many ways to make money | Risks with no sure money | Job is more certain | Might lose job |

| Control | Can be as creative as you want | Must push yourself to get things done | Others tell you what to do | You don't get to choose much |

The choice is not easy. It all hangs on where you are now, how much risk you can take, and what you aim to get in the end.

How to Pick Your Best Path

Deciding between a part-time gig or full-time job means knowing what you need and what's going on in your life. What works for one person may not work for you. To choose well, first look closely at your money and life needs.

Ways to Check In With Yourself

Start with your money status. Look at your bank info, bills, and work pay to know your monthly costs and what you make. For example, if you make $3,500 a month from your job and your bills are $3,200, you might handle changing income.

Next, think about how you handle risk. Are you okay with money that changes, or do you want a set amount each time? Some love the ups and downs of part-time work, while others like to know exactly what they will get every two weeks.

Your life stage matters a lot too. A 25-year-old with no big duties at home can take more chances than a 35-year-old with a family. If you care for others, things like health care and steady money from a full-time job might be a must. But if you're young and have backup, taking chances might feel okay.

Think about your work dreams too. Do you want to climb high in a company, or do you hope to work for yourself? Also, be true to yourself about your energy and time. Side jobs can take 60-70 hours a week, so it's key to know how much extra work you can do without getting too tired.

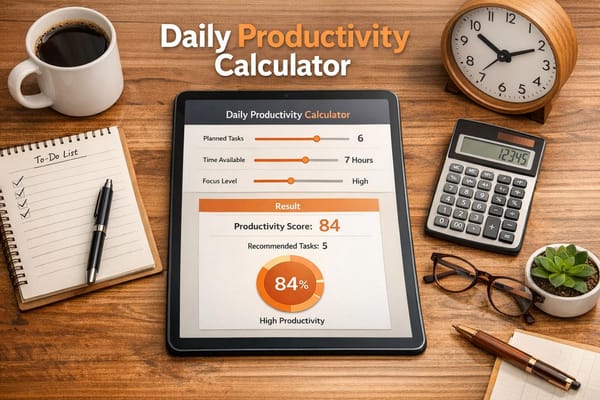

Tools and Tips to Help

Good tools can help you make a smart choice and do well. For money, apps like Mint and YNAB (You Need A Budget) can track your spending and show you where your cash goes. This helps whether you're getting ready for the shifts of part-time work or handling steady full-time pay.

Time tools like Toggl or RescueTime can show how you really use your hours. Many think they have 20 hours a week for a side job, but find they have just 8-10. Knowing your real time can help you be real with your plans.

If you're trying a side job, start small. Say you want to do graphic design on the side, take a few small gigs first. This lets you see how much you might make per hour and if you like the work beyond just a hobby.

Using spreadsheets can change the game. Set up spots for different money levels, costs, and time needs. Put in true numbers - not perfect dreams - to see how each choice might work out.

Lastly, tools like TurboTax Self-Employed or tips from a tax pro can help you know the tax rules for side jobs. They are not the same as those for normal jobs with a W-2.

When you mix these tools with a good look at your own case, you'll be more set to pick a way that fits what you need and want.

Setting Income and Growth Goals

When you pick income goals, be clear and keep it real. Don't just say, "I want to make more money." Aim for a clear goal like, "I want to make $5,000 each month in one year." Clear goals let you see if you are getting there.

For a case, if your main job makes you $50,000 each year and your side job starts at $1,200 a month, a steady rise - like 20% each month - could end up making a huge change over time. Emma Ascott from Allwork.Space tells us this:

"Understanding when a side hustle is merely a supplementary activity and when it has the potential to become a full-service job is key to career planning".

Make both short and long goals. A short goal could be to make 25% of your full job pay with side work in six months. A long goal might be to only work for yourself in three years. These goals help you stay on track each day and give you a clear way for what's next.

Look at the need for your skills. Busy spots like web making, web ads, and health help often have more sure chances for side jobs to turn into full work. Look up what others in your field make as freelancers or small shop owners - not just the top stories you find online.

Also, look at the chance to grow in each job. Your main job may have a set way up that could grow your pay a lot in five years. But, your side job could bring even more, though it might take longer to get there. There's no one answer for all; it rests on what you want and when.

Keep in mind, 39% of people in the US now have side jobs, and the gig market brings in over $50 billion each month. You're not alone in these choices, and it's fine to choose what fits best for you now - even if you opt to switch later.

The key thing is to be real about where you stand, set doable goals, and stay open as you find what fits best for your life and dreams.

How to Win on the Road You Pick

When you pick a road, the hard part starts. No matter if it is a side job or a big all-day job, you win by making good plans, clear money goals, and using the best tools to stay right.

Time and Energy: How to Handle Both

It helps a lot to manage your time well so you do not feel too much on you. Set up a daily plan that fits what you need and must do.

For those with a side job, it is tough to keep up with a lot of stuff at the same time. Laura ✴️ N., from Corporate Women with Side Gigs, says this way:

"I truly believe that staying organized is the key to success when it comes to managing multiple responsibilities. And if there's one thing you take from this newsletter, it's that the #1 way to stay organized is creating a routine that works for you."

Begin by noting down all you need to do to free up your mind and set your main tasks first. Be true about the time you can give to your side hustle each week - this truth can keep you from getting too tired. Use about 30 minutes each week to plan out your time, splitting it between work, family, and side projects. Even little bits of time, like 45 minutes before dinner or an hour on a Saturday morning, can build up.

For those with full-time jobs, steady habits can make repeat tasks easier and save your mind power. In both cases, taking breaks often is key. As one pro says:

"Managing a side hustle alongside full-time commitments is a balancing act that requires careful planning, the right technology aids, and a commitment to your well-being."

After making your day plan better, the next move is to set money goals to keep your future safe.

Making Money Goals

Good money goals help lead you to long life comfort. Rather than just saying, "I want more cash", set a clear aim, like, "I will make $2,000 each month from my extra work in 12 months."

Noah Damsky, who started Marina Wealth Advisors, talks about how key it is to plan soon:

"You have to plan early and figure out what's most important to you - maybe it's figuring out a budget or sending your kids to college. The earlier you get clear on these priorities, the earlier you can actually start planning for where you want to go - and the more likely it is that you'll succeed."

Split your aims into near and some mid goals. If you have a side gig, it's smart to keep a save fund for 3-6 months of costs - or maybe a year if you work for yourself, since cash flow isn't sure.

Daniel Milks of Woodmark Wealth Management shares a plain but strong idea:

"One of the most effective strategies is to pay yourself first. Before covering any other expenses, set aside money for savings and investments to ensure your future financial security."

To save with ease, set up auto-transfers to move money into savings or stock accounts. As money flows in and bills pile up, check and tweak your money plan often.

Using FromZeroToGrow Tools

To keep up your drive, use good help like FromZeroToGrow. Whether you're growing a small job or doing great in a big job, their useful tips can boost your climb. The blog gives thoughts on mindset, will, and real ways to win.

For new ideas, look at good stories on FromZeroToGrow. These tales work as guides, mixing push with real tips you can use on your own path.

When you feel less pushed, the site's focus on will can keep you going. With pointers on making habits, it gets easier to push ahead, even when days are full.

The FromZeroToGrow email note is also great, bringing new thoughts and ways to grow right to your inbox. Talking and joining in with others there can also give new looks and help.

Add FromZeroToGrow to your week. Take time to look at new posts or old notes that hit home with your now needs. See it as steady learning for your work and life rise.

Final Thought: The Best Way to Set Up Your Future

Picking either a side job or a full job depends on you - no one rule fits all. With over 70% of Americans looking into extra ways to make money and 39% balancing side jobs with their main work, it's clear that many mix these options to fit their lives. These facts show more people now shape work to fit how they live.

What you pick must match your key beliefs, money needs, and big plans. A full job gives you a sure thing and perks, while a side job offers open times and a way to make money doing what you love. For instance, Americans who put in just 12 hours a week on their side jobs make about $13,000 a year on average. This tells us that even a few hours can lead to real money.

Note that your pick isn't fixed for all time. Many start with a full job to have money safety, then slowly grow their side job into more. Some begin with free work or part-time jobs and move to full jobs later. Being open with your job path lets you shift when your needs or life changes.

As Andreas Jones, who started Kinda Frugal, smartly puts it:

"While these tips can help you succeed, it's important to remember that finding the right balance is a personal journey - what works best will depend on your goals, energy and priorities."

Stop for a bit and think about where you are and where you want to go. Look at your money needs, your family, and your work dreams. You might pick a stable, full-time job or a flexible side job. Either way, doing well means making good plans and sticking to your aims.

Now is the best time to start making your future. Take that first step on the path that feels good for you.

FAQs

How can I know if my side job should be my main job?

To find out if your side job is ready to be your main work, look at a few key points. First, check the money it makes. Is it enough to pay for your life and reach your money goals? If yes, then you might be set to make the jump.

Then, think about if it can grow. Can you get more buyers or make more money as time goes on? If there's a need and you have space to grow, put a tick in the "yes" box.

You also need a good work plan. Do you know how much time and hard work it will take to change? Be true to yourself about if you can deal with more tasks, tax changes, and keep going when times get tough.

Lastly, see if this change fits with your life goals. Does it match what you want for yourself now and later? Taking time to think about these things can help you make a wise, sure choice on making your side job your main job.

When should I quit my full-time job to work only on my side job?

Choosing when to quit your main job for your side job is a key choice, and timing matters a lot. A good rule is to check if your side job earns about 75% of your main job's pay for a few months. This steady money is a good sign that your side job can keep you going.

Another key step is to make a money safety net. Try to save money to cover 6 to 12 months of living costs. This saved money can calm your mind and help you deal with unplanned issues as you switch to focus on your own business.

Before you jump in, see if your side job can grow well and stay strong over time. With these steps, you can face less money worry and have a better shot at making it in your own venture.